The Future of Autonomous Crypto Strategies

Make crypto trading smarter

What is the ZPT Project?

We Have Designed an Autonomous Strategic Infrastructure.

ZPT is a next-generation platform dedicated to intelligent algorithmic trading with integrated risk control.

While most systems are fragmented, ZPT unifies data, strategies, and management layers into a single engine.

It provides decentralized access to dynamic asset allocation and token-driven governance.

Ultimately, ZPT connects traders, protocols, and capital in a strategic autonomous crypto network.

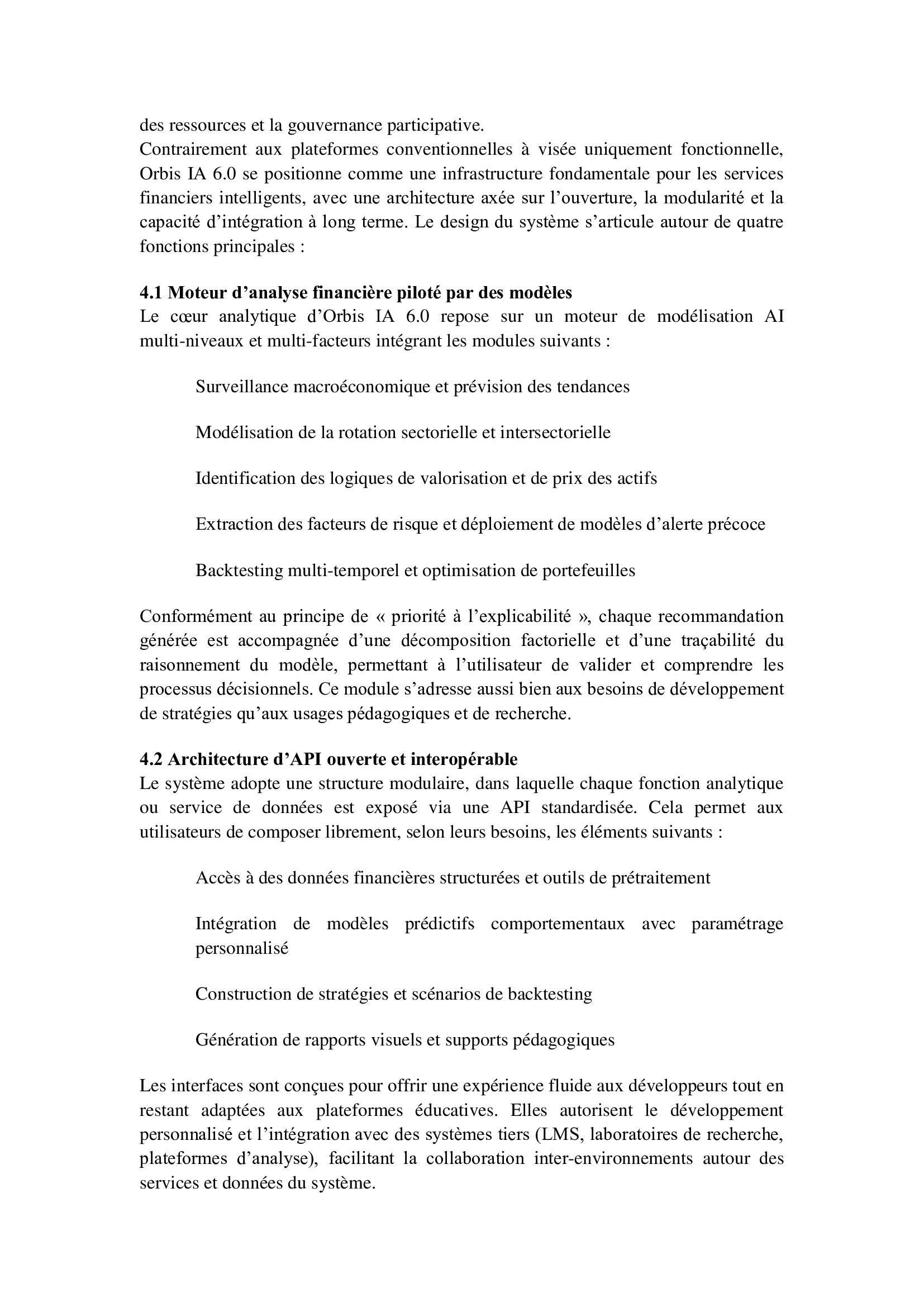

Token Economics

The economic model of ZPT is carefully designed to ensure its long-term sustainability. It guarantees the creation of value for all token holders within the ecosystem.

The architecture of the model enables the platform to adapt to emerging opportunities, with the community at the heart of its growth.

Total Supply: 100,000,000 ZPT

-

35% Public Recruitment

-

25% Ecosystem Incentives

-

15% Team & Advisors

-

15% Strategic Reserve

-

10% Liquidity Exchange

-

35% Product Development & R&D

-

30% Marketing, Adoption & Partnerships

-

20% Operations & Infrastructure

-

10% Legal Compliance

-

5% Strategic Reserve

Intelligent Execution, Powered by Algorithms

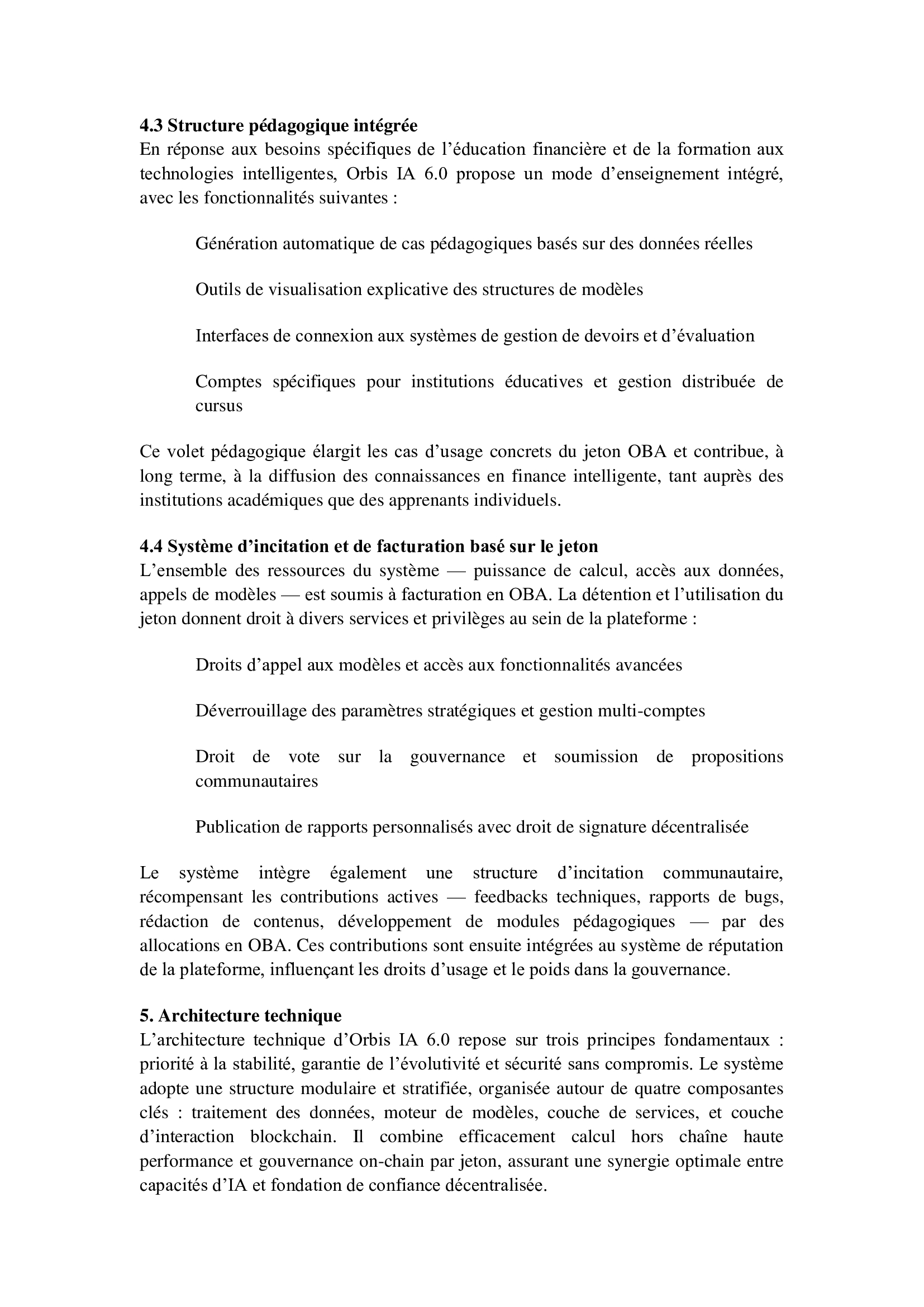

Roadmap

Strategic Development in Phases

February 3, 2025 – May 20, 2025

Phase 1 – ICO Launch Preparation

Strategic Goals:

- Establish the entity and build the team.

- Prepare marketing and community strategies for ICO.

- Define token distribution and launch roadmap.

February 3, 2025 – May 20, 2025

Phase 2: Initial Token Distribution

Strategic Goals:

- Complete the initial token sale and distribution.

- Guide the first round of user participation and token holders.

- Build an early community and establish key partnerships.

October 10, 2025 – February 10, 2026

Phase 3 – Market Value Management

Strategic Goals:

- Improve liquidity and stabilize the token market.

- Establish a price "safety margin" for secondary market expansion.

- Focus on strengthening investor confidence.

February 10, 2026 – June 10, 2026

Phase 5 – Secondary Market Expansion

Strategic Goals:

- Expand global trading channels and enhance market depth.

- Work with leading platforms to attract institutional and retail investors.

- Increase ZPT's brand recognition in secondary markets.

October 10, 2025 – February 10, 2026

Phase 4 – Core Holder Concentration

Strategic Goals:

- Refine token holding structure.

- Encourage the concentration of tokens in the hands of core holders.

- Prepare the foundation for global market accessibility.

October 10, 2025 – February 10, 2026

Phase 4 – Core Holder Concentration

Strategic Goals:

- Refine token holding structure.

- Encourage the concentration of tokens in the hands of core holders.

- Prepare the foundation for global market accessibility.

February 10, 2026 – June 10, 2026

Phase 5 – Secondary Market Expansion

Strategic Goals:

- Expand global trading channels and enhance market depth.

- Work with leading platforms to attract institutional and retail investors.

- Increase ZPT's brand recognition in secondary markets.

February 10, 2026 – June 10, 2026

Phase 6 – Global Integration and Partnerships

Strategic Goals:

- Open up third-party integrations and extend partnerships.

- Strengthen multi-market extension.

- Leverage strategic collaborations to enhance ecosystem adoption.

June 10, 2026 – June 10, 2027

Phase 7 – Ecosystem Closed-loop Development

Strategic Goals:

- Embed ZPT into FIN ALLIANCE's core applications such as AI trading and asset management.

- Build a self-sustaining ecosystem with integrated token payment systems.

- Drive real-world use cases to boost token value and ecosystem growth.

June 10, 2026 – June 10, 2027

Phase 8 – Decentralized Autonomous Finance (DeFi) Infrastructure

Strategic Goals:

- Evolve towards a modular, interoperable infrastructure for decentralized finance.

- Achieve full decentralization of governance and decision-making.

- Create a long-term, active consensus community to sustain growth.

Market Use Case

ZPT for Real-World Crypto Strategies

Portfolio Management

Investors use ZPT to implement decentralized, automated strategies that leverage AI-driven quantitative signals for multi-asset portfolio management.

Algorithmic Trading

Execution of high-frequency trades across multiple platforms to optimize market opportunities and enhance liquidity using ZPT.

Dynamic Rebalancing

ZPT supports automatic portfolio adjustments based on real-time market data, volatility, and emerging trends, ensuring optimal asset allocation.

Long-Short Strategies

Efficient implementation of both long and short strategies to maximize returns across market cycles, driven by AI-powered signals.

Backtested Analysis

ZPT leverages integrated backtesting capabilities, validating strategies using historical data to ensure performance consistency and accuracy.

Institutional Allocation

Supports large-scale institutional investment strategies by providing algorithmic asset allocation tools designed for complex portfolios.

Read Our White Paper

Access the full document to gain a deeper understanding of our vision, technology, tokenomics, and the strategic development of the ZPT ecosystem.

Frequently Asked Questions

Find clear answers here about our project, technology, and algorithmic operations.

What is the ZPT Algorithmic Engine?

The ZPT platform leverages advanced AI and quantitative models to automate crypto strategies, allowing seamless execution and continuous system optimization.

Can I use ZPT without trading experience?

Yes. The ZPT platform offers an intuitive interface, making it accessible for both beginners and experienced users to participate in algorithmic trading and portfolio management.

How is the ZPT token used within the ecosystem?

The ZPT token serves as a utility token within the ecosystem, granting access to strategies, governance participation, payment processing, and incentives for data contributions.